Hotel Brand Websites, OTA’s, Meta Search and Wholesalers: A Distribution Dilemma Within The Industry

Photo Source: Andrew Harrer/Bloomberg via Getty Images

By Nick Cohen

The year is 2001, and the world is still recovering from the tragedy of September 11

th.

The travel industry is in a downward spiral as fears of flying and

terrorism ripple across the United States and beyond, and hotels have

lost significant occupancy due to a decrease in demand.

Simultaneously, a fledgling technology is emerging which will

eventually take advantage of the internet explosion, as well as hotel

management’s desperation to fill rooms. It will reshape our industry

forever, and this platform now commonly referred to as Online Travel

Agencies, or OTAs, will allow hotels to easily sell their rooms on the

internet through new consumer facing websites such as Expedia,

Travelocity and Orbitz.

Fast forward to 2017. The OTA’s have gained the majority of market

share for online reservations, and digital platforms like Booking.com

and Ctrip.com have loyal member volumes that far surpass brand

websites. In many cases, the OTA companies are valued well beyond

traditional hotel brands (as of May 2017, Priceline Group has a market

capitalization of nearly USD 92 Billion). They have also helped to

create a new concept as they grew in popularity and scale over the last

number of years, and it was the precedent of transparency. Pricing that

was once hidden to the everyday user, could now be exposed to the whole

world, publicly, with a few clicks online. As OTA channels grew

enormously with time, so did the access to real time rates and

availability for virtually every hotel around the world.

With this concept in mind, from the OTA’s we have seen the rapid

expansion of ‘meta search’ channels. These are one-stop price comparison

platforms where a customer can view a price for a single hotel room

across multiple websites (without having to browse those websites

one-by-one). Sites within this category include Kayak, Trivago,

TripAdvisor, Qunar and Google, and they are all working to simplify the

travel research process for consumers.

Featured above are some of the most popular meta search channels

With the OTA channels continuing to grow through massive marketing

efforts and superior technology, and with meta search sites following

their lead, a relatively new challenge has emerged for hoteliers. It

represents a very complex dynamic between one of the most traditional

ways to sell a hotel room, and one of the most modern ways to sell a

hotel room. This once again all comes back to the concept of price

transparency. Wholesale has been a core business driver in hotels for

many years, helping properties build base business through private

negotiated rates and partnerships. Historically, these wholesalers would

sell their inventory offline to their own private networks of contacts.

Even though the pricing would typically be lower than publicly

available RACK rates, it was a reliable foundation of occupancy for

hotels to build off of.

As technology has become more sophisticated with Application

Programming Interfaces (APIs) readily available, we have seen the rapid

growth of wholesale rates being sold publicly, online, through some of

the powerful meta search channels mentioned above. This means that

wholesalers are selling discounted rates, which directly undercut brand

websites and OTAs, to anyone who has access to the internet. Beyond

just meta search, some OTA websites are now even positioning themselves

as ‘online marketplaces,’ where they too will sell wholesale inventory

directly instead of the inventory provided by the hotels. To remain

competitive and increase market share, online channels want to sell the

lowest price possible, even if it means reducing their own margins by

selling a cheaper room to the customer.

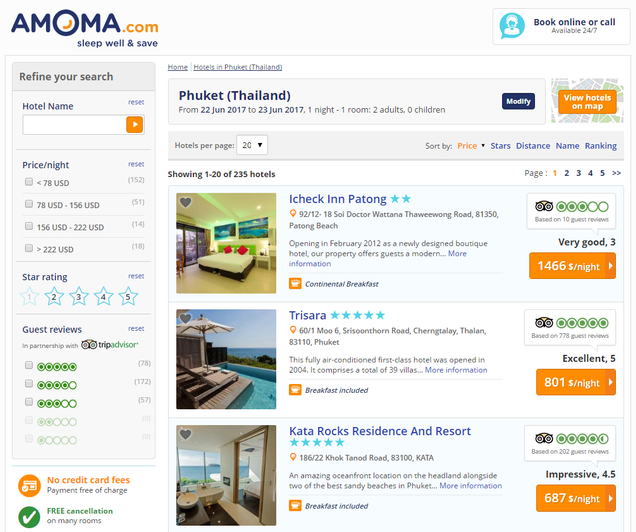

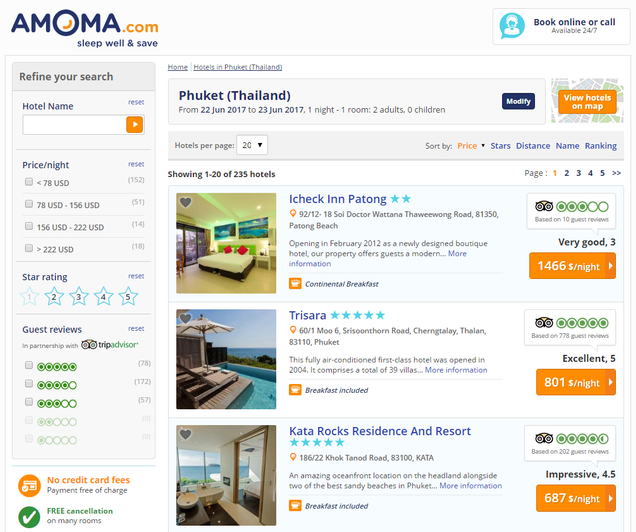

Meta

Search Websites such as HotelsCombined (shown above) showcase wholesale

aggregator sites like Amoma.com and HotelQuickly.com which have prices

that undercut the brand’s direct website and other OTA channels

You would think that hoteliers would want to fix this problem

immediately. Online wholesale business undercuts channels which are much

more profitable such as their direct brand website. This issue however

is multi-layered and is not easy to remedy for the following key

reasons:

Hotels still want wholesale business!

Hotels still maintain strong relationships with a number of wholesale

partners, big and small, and they rely on these partnerships to

generate base business. Turning off these channels would potentially

mean the loss of significant revenues, at least in the short term.

Although wholesale channels can undercut other websites when sold

online, they also still generate incremental business when sold offline

through the traditional method

Finding the source of whole business online can be very difficult

When wholesale rates appears online, it’s generally very difficult to

know which wholesaler specifically is providing that inventory. The

wholesale partners themselves don’t generally sell rooms through their

own websites, but sell their rates through wholesale aggregation

channels such as Amoma.com. It’s channels like Amoma who then sell the

rates online through their own interface, and promote their rates

through larger meta search intermediaries such as Trivago and

TripAdvisor. Generally the only way to find the true source is to make a

test booking online, and then track how that reservation comes into the

hotel’s central reservation system (each reservation is typically

flagged with an inventory source). Many hotels are reluctant to do this

since a booking requires use of a credit card and sometimes even

pre-payment, and then cancellation of that test booking is not always

easy to do. The test booking process is both cumbersome to manage at

scale, and is also financially risky for a hotel if those booking cannot

be cancelled.

Room

bookings can be made through Amoma.com and other wholesale aggregator

websites by anyone online. However, the back end wholesale source for

each booking from Amoma and other channels like it can be very

challenging for a hotel to identify.

Employee incentives are at stake

Within hotel sales departments, team members are still incentivized

to drive wholesale volume, regardless of where that volume is being sold

(offline or online). Wholesale partners generally don’t provide

specifics on how they are selling their inventory, and as long as room

allotments are sold, the responsible sales team members are satisfied.

This is creating an unavoidable rift between the direction of some sales

leaders with the revenue management and digital strategy teams.

So what’s next?

Hotel companies are dealing with this situation in a variety of ways.

Some are cutting off wholesale altogether since they simply can’t

control where their inventory is ending up. Others are maintaining the

partnerships, but are working to move away from static room allotments

and over to dynamic pricing and availability where the hotels have more

control over the inventory they send to the wholesalers. This is a major

problem facing the industry that very much remains unsolved.

If we take ourselves back to the 2001, price transparency was a

challenge for hoteliers. Properties simply didn’t have direct access to a

large enough segment of customers, therefore traditional partnerships

like wholesale was an absolute necessity. With the growth of the OTAs

though, and the emergence of new technologies such as meta search, that

access is no longer an issue. The world is accessible for each hotel

with a few quick key strokes on a computer. It is now only a matter of

time until hoteliers make one of the following decisions:

- Utilize wholesalers purely as another online distribution channel,

selling rates that are parity with every other website (brand.com and

OTAs)

- Remove wholesale out of the channel mix altogether, realizing that

room inventory can be be sold among the multitude of websites and

digital platforms already available